Life Insurance Deep Dive Part I

In my post How to plan for the unknown I started discussing some of the incentives and benefits of owning a life insurance and we saw that some people might need one to achieve peace of mind or other family goals. Now I am going to dive deeper into the world of life insurance and explain some of its uses, important factors when choosing one, the usual process and how to compare companies and contracts.

Let’s start with some basic definitions. Insurance is a contract in which one party agrees to indemnify the insured party against loss, damage or liability arising from an unknown event. With other words in case you lose something of value that has been insured the insurance company is going to recover this value with a cash reimbursement. When talking about life insurance the loss can arise from unknown event that costs a human life.

There are several uses of life insurance:

The most widespread is security for the survivors as the beneficiaries receive the insurance proceeds to compensate for loss of wages.

Another use is estate creation. Life insurance is the fastest way to create wealth. Savings and investments creates wealth as well but buying life insurance creates immediate estate for small cost.

Life insurance can be used as a savings vehicle. Most of the whole life insurance contracts have cash value which is available to the owner at any time. It grows tax deferred and usually offers greater yield than more conservative instruments like savings accounts or certificate of deposits.

An important advantage of life insurance is its liquidity. It provides access to cash by using it as a collateral for a loan. In addition, sometimes these loans are interest free if returned within specific time.

Now, let’s take a look at how to calculate the right death benefit to shop for.

There are two approaches. The human life value approach and the needs approach.

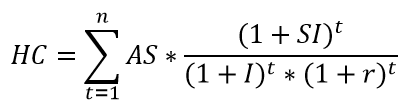

The human life approach introduces the concept of human capital. Human capital is the value of all wages within the working life of an individual. For example a 35 year old person who wants to retire at 65 has 30 years remaining in the workforce. We can calculate his or her human capital by taking the current salary let’s say 100K a year and multiplying it by 30 which is 3M. If we want to be more precise we can take into consideration salary increases, time value of money and inflation. If we want to include those, the calculation will look as follows:

A numeric example will look as follows:

- HC = human capital

- n = time or number of years

- AS = annual salary = 100K

- SI = annual salary increases = 3%

- I = Inflation = 2%

- r = real interest rate = 1% (sometime this is confused with the nominal interest rate. Remember (1+nominal interest rate) = (1+real interest rate)*(1+inflation) or a linear approximation: nominal interest rate = real interest rate + inflation. We are using real interest rate as inflation effect is already included in the equation.

Using the formula we calculate a Human Capital equal to 2.99M which can be used as a desired death benefit. Please note that the formula includes assumptions which might be different from the actual turn of events.

The other approach in figuring out the right death benefit amount to shop for is the needs approach. This method relies on determining various needs of resources after an unexpected death and using the sum of them for death benefit calculation. In my last post How to plan for the unknown I have given a comprehensive example of this approach but let’s review on a higher level.

Surviving spouses with children will face both need of immediate cash flow and subsequent need of regular cash inflows in order to keep the household running. Starting with the immediate cash needs I have listed below some of the most common categories.

- Costs Associated with Death – final medical expenses, funeral expenses, day to day expenses family maintenance

- Debt Cancelation

- Emergency Reserve Fund

- Education Fund

- Retirement Fund

- Bequests

When determining subsequent regular cash inflows the family needs to think about what part of the lost salary needs to be replaced, how the social security benefits blackout periods will affect cash inflows and whether they would like to live on the capital they have by liquidating it or retaining the principal for future generations.

Not always all the lost income needs to be replaced. A specific analysis can be performed depending on whether the surviving spouse will start working, if there is a need of additional training and education, how much does child care cost and what are the expected regular family expenses.

Social security benefits are subject to a blackout period. During this time frame the surviving spouse and children do not receive benefits. It lasts between the time the youngest child reaches age of 16 and the time the surviving spouse becomes qualified for retirement benefits at age of 60.

Principal retention or liquidation will have a huge impact on death benefit calculation. If the principal is scheduled to be amortized and at some point liquidated a much smaller death benefit will be needed to support the family. If the family wants to keep the principal untouched for future generation then only the interest on this principal will be available for expenses. Hence, the death benefit will need to be substantially larger in order to achieve the same cash flows.

After deciding on how much life insurance the family needs the next step is choosing the right company and the right product. Usually products and companies will be very close in their offerings so both companies and products should be compared at the same time. I will start by explaining how to compare companies first and then will continue the discussion with different product offerings.

Life insurance companies usually are either stock companies or mutual companies. Is there a difference?

Stock companies are corporations owned by the stockholders who provide the capital for creating the company and hiring managers to operate the business. Some might argue that stock companies are more focused into profits as the managers who operate the business on a daily basis are hired by the board of directors who represents the stockholders interests.

Mutual companies on the other hand are corporations owned by the policyholders. This means that the company is actually working to satisfy the interests of both its clients and owners which in this case are the same people. Some might argue that this incentivize management to be more concerned about the well-being of its clients and pursue more customer friendly policies than stock companies.

Regardless of the type some of the most important things to look at when comparing insurance companies are what is their ability to meet ongoing insurance obligations and how well they are capitalized. The answers to these questions can be found by looking at independent rating companies. They usually assign ratings to the companies depending on their financial strength. The methodology used is also usually available for the public together with explanations of the particular ratings.

| Web site | Agency |

| www.ambest.com | A.M. Best Company, Inc |

| www.fitchibca.com | Fitch Ratings |

| www.moodys.com | Moody’s Investor Services |

| www2.standardandpoors.com | Standard & Poor’s Insurance Ratings Services |

| www.thestreet.com | The Street.com |

Remember that whenever you compare two identical insurance products from two different companies it will make sense that companies with lower ratings will sell their products cheaper as you will be taking a slightly higher risk of not being able to collect your insurance proceeds. At the same time keep in mind that the insurance business is highly regulated and most companies have additional reinsurance contracts to make sure policyholder’s claims will be met. So even though ratings will be very close among insurers they can be used for better understanding product prices.

In my next post I will continue with the different types of products, will compare whole life versus term life products and explain some of the most popular products. Later I will introduce the process you will encounter if you decide to go and buy insurance for you and your family.

Leave a Comments