Financial Planning Models

When doing financial planning for a client or for yourself, one can use different financial planning models in order to frame ideas, goals, and resources to create the plan. The models I use are acting as complements to each other rather than being mutually exclusive. Each model brings specific view of the same task at hand – creating a strong investment policy and sound financial plan.

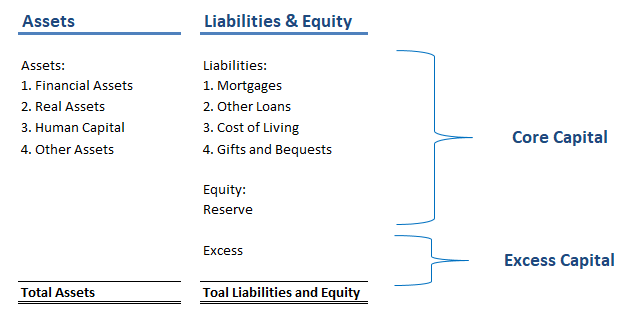

The first financial planning model we are going to look at is the Asset Liability Management (AML) approach for asset allocation. This model analyses short and long term liabilities and allocates the available assets in a way to satisfy the timing of the liabilities. For short term and ongoing liabilities like cost of living, loan payments, insurance premiums, the assets may be allocated in money market funds, savings accounts that provide the required liquidity for satisfying these short term financial obligations. For longer term liabilities like, retirement income needs, gifts and bequests the assigned assets may be invested in a more risky and less liquid assets due to the longer time period at hand. The model however assumes small surplus between assets and liabilities and this is why we will introduce the second model that splits the individual balance sheet into core capital and excess capital.

The core and excess capital model builds on the AML framework by assuming that even after satisfying all the individual liabilities with the assets at hand, there might be additional resources to be allocated. The focus in the model, however is determining one’s core capital needs. It is a process of identifying specific goals and desires of the particular individual and assessing very carefully his income potential. Looking below at the diagram we can utilize the AML framework to identify the core capital for this particular example. This will include all major lifelong liabilities, including desire for bequests and some equity reserve for contingencies. On the assets side we will include all real and financial assets owned and will also estimate the human capital asset. (For more information on Human Capital please see my prior post Life Insurance Deep Dive Part I). Any surplus above the assets needed to satisfy our core capital liabilities is considered excess capital.

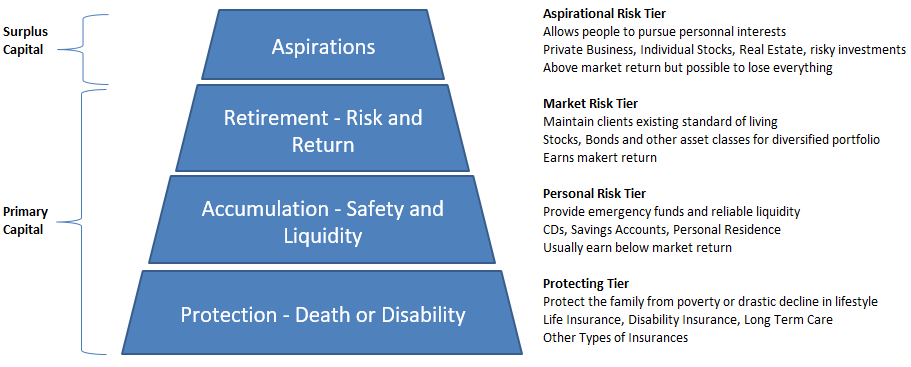

The final financial planning model that puts the ideas from the first two together and builds on them is called Goals Based Investing. The idea is that you can create your portfolio and allocations based on the specific goals you have. You may arrange these goals based on their significance to an individual well-being starting with the most critical at the bottom and building the rest of the pyramid upwards. Each following layer will be required to have a higher return and consequently will bear more risk. Looking at the figure below we can see that we start with protecting our assets with insurance and continue to build with savings and retirement funds. Each layer represents different allocation bucket. It is also important to identify which layers constitute the primary or core capital which is considered as a higher priority in one’s financial plan versus the surplus or excess capital that can be looked at as a vehicle to participate in a more risky ventures.

Leave a Comments