Renting vs Buying Decisions

Renting or buying is a question that needs careful assessment of our own values and priorities, however we still can perform a reasonable analysis and help ourselves really understand quantitatively what each option entails.

Renting a place is a simpler option and it usually involves initial down payment covering the first and the last month of tenancy, security deposit for contingency damages caused by the tenant and periodic fixed payments (the rent) for the life of the lease term. Often residential lease agreements are made for 1 year, however longer lease contract terms can also be negotiated.

On the other side buying your own home especially if you would need to apply for a bank loan is a more complex option. First let’s take a look at the expenses related to the house itself. Property taxes is one such expense. The average property tax in MA is a little more than 1% and on national level this percent ranges from 0.3% to 2.35%. A good article for the different property taxes can be found here:

https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/

For our sample analysis we will use 1% for simplicity. The property tax is based on assessed value of the house. If we assume we want to buy a house for $500,000 we should expect to pay about $5,000 in property tax for the first year.

Another common expense for homeowners is home insurance. There are different companies and coverage policies so the cost may vary greatly. Zillow suggests you should expect to pay about $35 for every $100K of home value per month.

https://www.zillow.com/mortgage-learning/homeowners-insurance/

This brings our example with the 500,000 house to an annual homeowner insurance expense of $2,100.

It is reasonable to believe that the house you buy will need expenses for maintenance. These expenses are hard to predict and it is possible that they won’t be spread out nicely throughout time. More often than not they will be concentrated in a month when something brakes and then you might enjoy a year or two with no fixtures to take care of. As a general rule of thumb you can expect to spend anywhere between 1% and 2% of the value of the house for maintenance. Going back to our example with the half a million house it is at least $5,000 that should be apportioned for maintenance.

Depreciation is a different concept depending on who you discuss it with. Accountants usually use depreciation tables to expense the value of assets spreading the expenses throughout the useful life, tax advisors will use depreciation as a mean to lower your tax liability by trying to expense as much as possible earlier in the life of the asset. However, here I will try to stay away from these uses of depreciation and look at it as the expected loss of marketability of my sample house. In essence if I buy a brand new home now and I maintain it so it is in crisp condition after 100 years it will be crazy to think that in 100 years someone will be willing to pay me the same price as for a house that is brand new. So depreciation here will reduce the value of the house compared to a brand new house but it will never bring it to 0 as the land it is built on cannot be depreciated and if the house is maintained it can still provide a place to live in. Our best estimate is that a house will lose 50% for 50 to 100 years or about 0.5% to 1% a year compared to new homes built. In our example we will use the upper range which is 1% a year and we would assume the house will lose 30% of its value at the end of a 30 yr mortgage.

When we talk about getting a loan to buy a house we need to assess several additional variables. One of them is the down payment. It is important because it gives us information how much loan we need to take, how much equity we put on the line for the deal and also if there will be any additional private mortgage insurance. If we would like to make sure our lender is not going to require private mortgage insurance in addition to the interest we need to pay for the loan we should be ready with at least 20% of the value of the house for a down payment. In our example this is equal to $100,000.

Principal and Interest payments are usually calculated so that you would pay off the loan for the house in 15 or 30 years by having a fixed monthly payment for the life of the mortgage. In the beginning of the loan the interest part will be substantial due to the large outstanding balance. With the years go by though the interest is going to decrease and the principal payments will increase reducing the outstanding balance faster. All the calculations though will be done by the loan officer at your bank who will tell you the interest rate for the loan and your monthly payment. Here for our example we will use an interest rate of 4%.

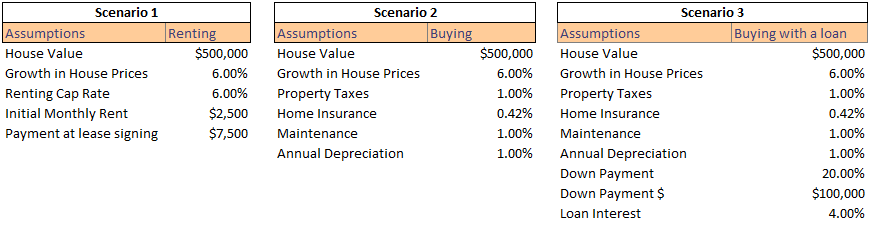

Putting all the moving parts together we can build a model that can help us assess three different scenarios that allow us to have a place to live in. We can either rent a half a million dollar house, we can buy it or we can buy it with the help of a loan. Let’s take a closer look at our model and what does it tell us:

First here are all the assumptions we discussed above. In addition we are estimating that the housing market will continue its trend for the past 40 years and will continue to increase by about 10%. Keeping in mind that we also have experienced 4% average annual inflation for the period we adjust our price growth to 6%.

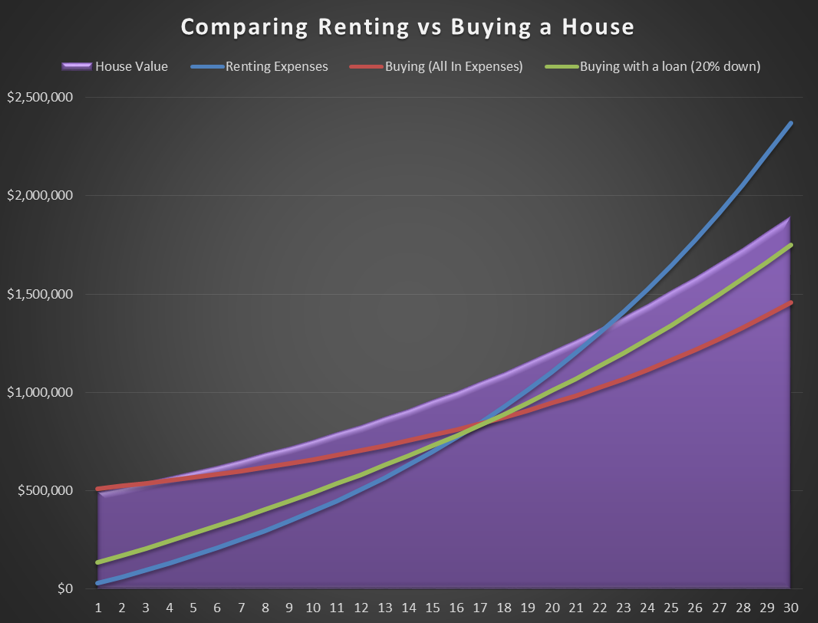

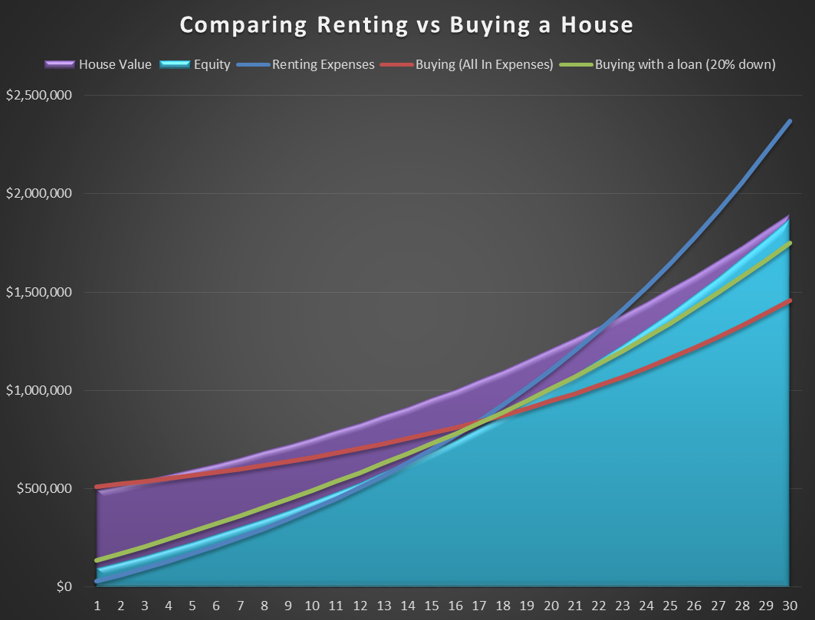

By plotting the three different scenarios together with the expected house value we can observe several interesting outcomes:

- Renting is the cheapest scenario in terms of cash outflows for the first 16 years which is more than half of the loan term.

- Buying with a loan (20% down) gives us very little advantage in terms of investment. The house value at the end is just marginally higher than our total expenses. What is more, the loan or the leverage we use may backfire if we need to sell earlier for any reason. Our equity in the house will equal all the cash outflows not earlier than 20 years.

- Buying out right gives is the biggest advantage in terms of price appreciation, however the initial outflow is substantial, perhaps even unrealistic for a working family household.

As a conclusion we should make clear that all these options have inherent risks and it is hard to decide which one is best as it depends on the individual’s goals and objectives. However, doing an analysis like this can give you a better understanding what each option really means and what will be better for you.

Vik,

Good article. Very nicely put.

One thing to consider is, you do not always have to sell the property if something were to happen. You can always rent the home out. In this market with rents being so high, it makes more sense to start building equity by way of purchasing your own home. If for some reason you outgrow the place, you will already have the equity from your current property, that you can use as a down payment, instead of starting from scratch or digging into your savings.

Feel free to reach out to me with any questions that you might have.

James A. Garcia, REALTOR

Coldwell Banker Residential Brokerage

(508) 981-0259 -Cell

james.garcia@nemoves.com

Thank you for the input James. I am always interested in opinions from industry participants. You are making a valid point but do not forget that usually people have budget constraints, liquidity needs and becoming insolvent is actually much easier than one may think. A house purchase can easily dry up lifelong savings and if a person becomes disabled even for a short period of time or experience unexpected revenue shortage the house might become the only place to look at for closing the budget gap. Conceptually though, I agree that the buying option in the long term provides a better value and this is what the analysis shows. The risk though is in the short term when we have families spending 100% of their income to cover for their month to month expenses and putting down all their savings for a house down payment.